Imported Beef Prices Continue to Drag Down Domestic Cattle Prices

China has defended its newfound drape equally the world'south largest imported beefiness market this year. A stiff economical rebound afterwards initial COVID-19 disruption and a substantial meat shortage due to African Swine Fever (ASF) have bolstered China'due south beef imports over the last yr, with this momentum continuing in contempo months.

While Prc pork prices have declined considerably since the Lunar New year, suggesting pork supplies have rebound, the sheer magnitude of sow herd liquidation and sporadic recurrences of ASF suggest this may be short-lived. Nevertheless, cooling pork prices have yet to drag beef prices downwardly and beef imports have continued to expand.

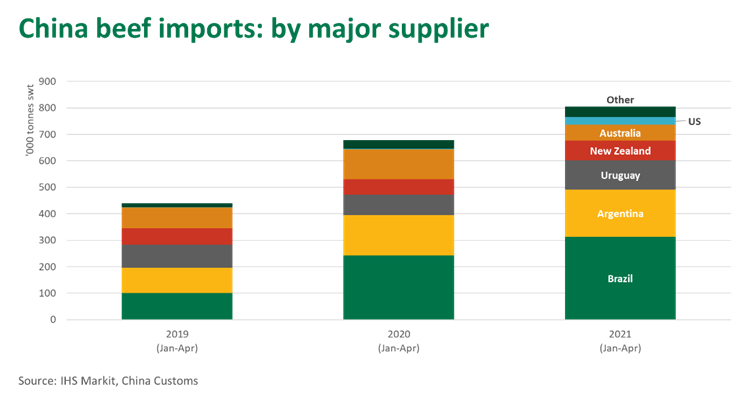

Over the past decade, China has continued to open up its beef market to an always-growing list of suppliers – near of the beef heavyweights have enjoyed expanding merchandise into the market. Over the year-to-May period, Cathay beef imports increased 18% year-on-year, with all height 10 suppliers (except Australia) recording double-digit growth.

However, two mainstays of the market place, Australia and Argentina, take recently experienced reduced access. Meanwhile the Usa, a relative newcomer, has seen the Phase-One Understanding translate into a fast-growing beefiness merchandise. The beef products and marketplace segments filled past all three suppliers are non entirely interchangeable, and availability from other exporters may before long get constrained.

Changes in market admission

- Australia: a range of technical issues resulted in the pause of vii beef establishments in 2020 that are yet to be relisted. While cattle and beef supplies have been tight due to Commonwealth of australia's current herd rebuild, beef exports to China declined 42% year-on-year over the year-to-May period (compared to xviii% for all other markets). The reduced merchandise has been heavily influenced by the pause of establishments.

- Argentine republic: in an attempt to cheque rising domestic beefiness prices, in mid-May Argentina's Peronist government announced a thirty-twenty-four hour period ban on beef exports to all markets other than those managed by tariff rate quotas (TRQ), such as the Usa and the Eu. After, the Argentine government appear measures to limit beefiness exports to 50% of the July-December 2020 monthly average volume through to the cease of August and ban the export of select cuts for the remained of the twelvemonth. Such measures could substantially restrict the volume of Argentine beefiness exports to Prc, its largest market. Moreover, the return to interventionist regime policies will continue to cloud the long-term outlook for Argentine beefiness exports.

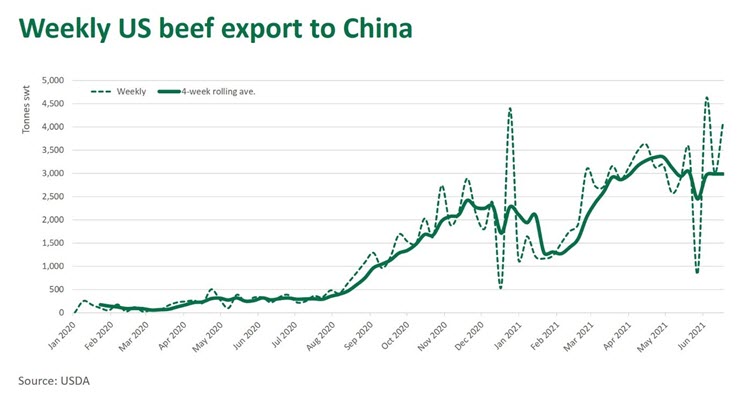

- United States: the Phase-One Agreement struck betwixt the US and China at the start of 2020 provided unrivalled technical access for U.s. beef exports to Communist china. Not just did the agreement wind back trade state of war tariffs, but the US was likewise permitted to export HGP-treated beef (albeit within maximum residue limits and with beta-agonists still banned) and beefiness from cattle over 30-months of age to China. Furthermore, the US was given the ability to apply a systems-based approach to China establishment approvals (dissimilar the rest of the globe, which seeks blessing on a case-by-case basis). This allows it to grant new establishments access at a time when COVID-xix has seen other countries' approvals grind to a halt. While initial trade was slow, United states beef shipments to Cathay have surged in contempo months.

So, what could these changes hateful for the Red china imported beef market?

Firstly, in the case of Argentina and Commonwealth of australia, information technology is unclear how long and in what grade restricted access may persist. Both could be reversed at relatively short notice.

Secondly, while the Stage-One Agreement was a political deal, and the China-US political relationship has non improved nether the Biden Assistants, there is little sign that either party is nigh to walk away from the pact. Favourable U.s. beef access to Prc looks reasonably safe, at least for the rest of 2021.

The bulk of Argentine and a large share of Australian beef exports to China are lower-priced commodity products, such every bit frozen manufacturing beefiness and hindquarter cuts. The U.s. has not traditionally exported these items to North Asia, given its vast domestic appetite of such product to produce burger patties.

Reflecting variation in both quality and cuts mix, the average Mainland china import price of US frozen boneless beef in April was US$7.83/kg, compared to US$7.08/kg and US$4.49/kg for product from Australia and Argentina, respectively.

To supervene upon the commodity beef from Argentina and Australia, other suppliers – such every bit Brazil, Uruguay and New Zealand – may need to fill in the gap, although the gap left by Argentina lonely could be 200,000–250,000 tonnes per annum and beyond the means of 1 or a few major suppliers.

Us beefiness in People's republic of china is capitalising on the reduced presence of premium Australian product, particularly grainfed loin cuts, and tapping into the fast-growing demand for high quality beef in the market. While the U.s.a. has a substantial supply base of operations to draw on and Chinese demand is strong, China still needs to compete with the US domestic consumer and other affluent buyers in North Asia. Demand in the US is currently red hot, as the economy surges among unprecedented stimulus and a successful vaccine gyre-out, and beefiness prices have jumped going into summer. This pricing pressure may presently weigh in on US beef shipments to Cathay.

In addition, overwhelmed supply chains and logistics have largely limited United states beefiness exports to China to frozen bounding main-freight. Commonwealth of australia remains the largest supplier of chilled beef into the market.

To engagement, China's demand for imported beef has yet to prove signs of receding. With Argentina and Australia limited by market access and other exporters already heavily geared to the marketplace, Red china beefiness imports may soon come upwardly against supply constraints. While the United states is the world's largest supplier, it will go along to operate in premium, high-priced segments given its price point and demand to remainder the carcase domestically. That said, market access can change overnight, as evident recently, and will go along to shape the Mainland china imported beef market.

Source: https://www.mla.com.au/news-and-events/industry-news/access-defining-chinas-imported-beef-market/

0 Response to "Imported Beef Prices Continue to Drag Down Domestic Cattle Prices"

Post a Comment